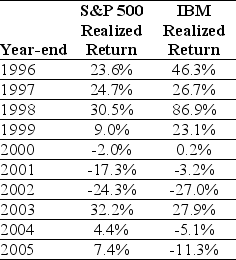

Use the table for the question(s) below.

Consider the following realized annual returns:

-The average annual return over the period 1926-2009 for the S&P 500 is 11.7%,and the standard deviation of returns is 20.5%.Based on these numbers,what is a 95% confidence interval for 2010 returns?

Definitions:

FIFO

Stands for "First-In, First-Out," an inventory valuation method where the first items placed in inventory are the first sold.

Merchandise Sold

Merchandise sold refers to the completed sales or the process of selling goods that are part of a company's inventory.

Weighted Average

A calculation that takes into account the varying degrees of importance or sizes of components in a dataset, providing a measure that reflects their relative contributions.

Inventory Costing Methods

Techniques used to determine the cost of inventory sold and remaining in stock, including FIFO, LIFO, and average cost methods.

Q5: Suppose a stock is currently trading for

Q5: You own shares in two different companies,Ace

Q8: The outstanding debt of Berstin Corp.has ten

Q22: The post-money valuation of your firm is

Q24: For each 1% change in the market

Q44: What is one of the major advantages

Q57: Treasury bill returns are 5%,4%,3%,and 6% over

Q71: Under the indirect method, an increase in

Q72: The following data represent selected information from

Q76: A firm's ability to pay current liabilities