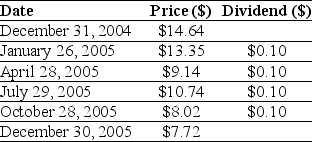

Use the table for the question(s) below.

Consider the following price and dividend data for Ford Motor Company:

-Assume that you purchased Ford Motor Company stock at the closing price on December 31,2004 and sold it after the dividend had been paid at the closing price on January 26,2005.Your total return rate (yield) for this period is closest to:

Definitions:

Capital Employed

The total amount of capital used for the acquisition of profits by a firm or project, typically represented by the value of all assets minus current liabilities.

Financial Leverage

The use of borrowed funds to increase the potential return on investment, often measured by the ratio of a company’s debt to equity.

Financial Leverage

Financial leverage refers to the use of borrowed funds to increase the potential return of an investment, amplifying both potential gains and losses.

ROE

Return on Equity, a financial ratio that measures the profitability of a firm relative to shareholders' equity, indicating how efficiently a company uses investments to generate earnings growth.

Q6: Which of the following statements is most

Q7: To estimate the value of a company's

Q44: For most companies, tax expense equals tax

Q46: A firm is considering acquiring a competitor.The

Q66: Under the direct method of preparing the

Q71: When the returns of two stocks are

Q81: Financial managers do not need to use

Q87: Prior-period adjustments are added to or deducted

Q97: Investors should earn a risk premium for

Q123: Deferred tax liability is computed by multiplying