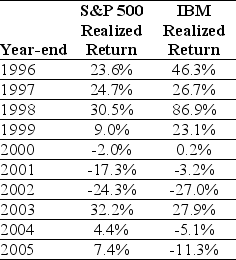

Use the table for the question(s) below.

Consider the following realized annual returns:

-The average annual return over the period 1926-2009 for the S&P 500 is 11.7%,and the standard deviation of returns is 20.5%.Based on these numbers,what is a 95% confidence interval for 2010 returns?

Definitions:

Molecular Data

Information obtained from the analysis of the molecular structure of biological substances, such as DNA, RNA, and proteins, used for studying genetic relationships and evolutionary patterns.

Structural Differences

Variations in the physical or anatomical organization between objects, organisms, or systems.

Evolutionary History

Refers to the sequence of events and changes that have led to the current diversity and form of life on Earth.

Derived Characters

See shared derived characters.

Q2: The two ways to format the operating

Q3: Items appear on the income statement in

Q39: Epiphany is an all-equity firm with an

Q44: When performing a trend analysis, the base

Q47: Which of the following would NOT appear

Q57: Treasury bill returns are 5%,4%,3%,and 6% over

Q68: Asterix Corp has debt with a book

Q80: The Ishares Bond Index fund (TLT)has a

Q86: A low inventory turnover may indicate that

Q104: Moon Company plans to issue 10 million