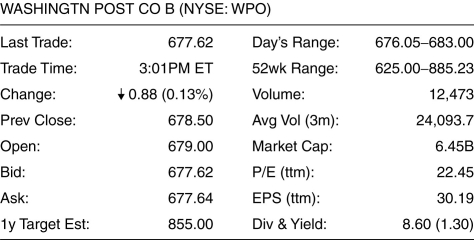

Use the figure for the question(s) below.

-Using the above information,how much would you receive if you sold a share of Washington Post stock?

Definitions:

Qualifying Relative

A term used in tax law to describe someone who doesn’t have to live with the taxpayer all year but must meet certain financial support and income criteria to be claimed as a dependent.

Gross Income Test

A requirement for determining if someone can be claimed as a dependent, based on their income level.

Specific Tests

Refer to criteria or conditions applied to determine eligibility or compliance in various contexts, such as tax law or regulations.

Qualifying Child

A dependent of a taxpayer that meets specific IRS criteria related to relationship, age, residence, and support for eligibility for certain tax benefits.

Q5: Historical evidence on the returns of large

Q7: A portfolio of stocks where each stock

Q10: Tryout Corporation's balance in its land account,

Q13: Stocks tend to move together if they

Q58: Which of the following is typically used

Q59: Red Deer Plumbing Supply Co.earns $4.50 per

Q72: Your investment portfolio contains 100 shares of

Q77: When computing earnings per share, preferred dividends

Q107: The purchase of held-to-maturity securities would be

Q119: Under the direct method of preparing the