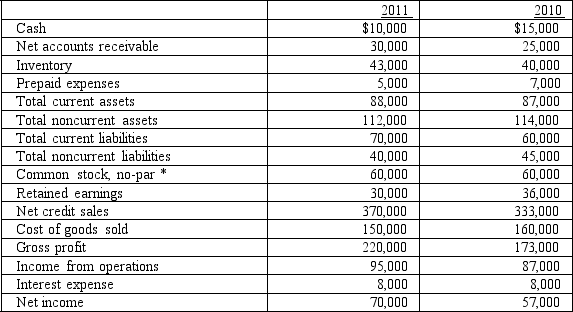

The following data represent selected information from the comparative income statement and balance sheet for Dunkin Company for the years ended December 31, 2011 and 2010:  * 10,000 shares of common stock have been issued and outstanding since the company was established. They had a market value of $90 per share on December 31, 2010, and they were selling for $91.50 on December 31, 2011. The earnings per share for Dunkin Company for 2011, was:

* 10,000 shares of common stock have been issued and outstanding since the company was established. They had a market value of $90 per share on December 31, 2010, and they were selling for $91.50 on December 31, 2011. The earnings per share for Dunkin Company for 2011, was:

Definitions:

Comparison Universe

A set of similar investment options or benchmarks used for evaluating the performance or characteristics of a specific investment.

Jensen Measure

A performance evaluation method that measures the excess returns a portfolio generates over its expected return, given its level of market risk.

Absolute Measure

A term used in finance to describe a statistical measure that is not relative but quantifies an actual amount or change.

CAPM

The Capital Asset Pricing Model, a theory used in finance to determine a theoretically appropriate required rate of return of an asset, considering risk and the time value of money.

Q1: Ford Motor Company had realized returns of

Q16: Unrealized gains and losses on available-for-sale securities

Q17: When we use the WACC to assess

Q25: A company in the grocery store business

Q43: When a company holds a receivable denominated

Q46: Put the following steps of the financial

Q74: The shares of private corporations are traded

Q74: Your investment over one year yielded a

Q81: To calculate the taxes owing on dividends

Q81: 1.investments have a current market value of