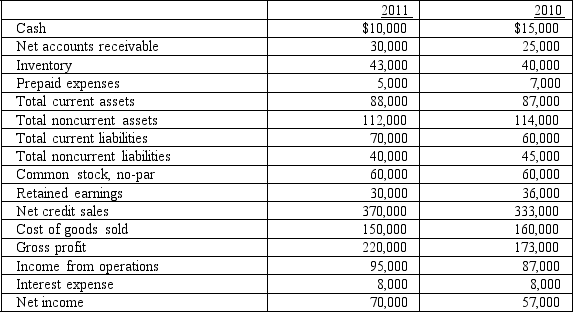

The following data represent selected information from the comparative income statement and balance sheet for Dunkin Company for the years ended December 31, 2011 and 2010:  The accounts receivable turnover for Dunkin Company for the year ended December 31, 2011, was:

The accounts receivable turnover for Dunkin Company for the year ended December 31, 2011, was:

Definitions:

Withholding Allowance

the portion of an employee's income that is not subject to tax withholding by the employer, typically used to calculate the amount of income tax withheld from a paycheck.

Federal Income Tax

A charge imposed by the national government on the yearly income of individuals, corporations, trusts, and various legal bodies.

Gross Earnings

The total amount of revenue or income earned by an individual or business before any deductions or taxes are applied.

Net Pay

The amount of money an employee takes home after deductions like taxes and retirement contributions have been subtracted.

Q17: Your portfolio has 50% of its value

Q31: The direct method of preparing the operating

Q48: The Capital Asset Pricing Model (CAPM)says that

Q54: Accumulated other comprehensive income:<br>A)appears on the income

Q62: A firm incurs $70,000 in interest expenses

Q86: A low inventory turnover may indicate that

Q91: The study of percentage changes in comparative

Q95: The S&P TSX Composite index delivered a

Q100: As we add more uncorrelated stocks to

Q111: An efficient capital market is one in