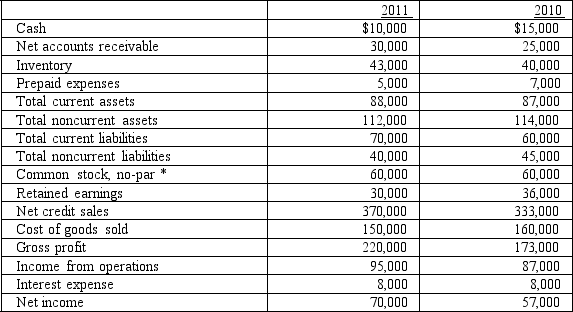

The following data represent selected information from the comparative income statement and balance sheet for Dunkin Company for the years ended December 31, 2011 and 2010:  * 10,000 shares of common stock have been issued and outstanding since the company was established. They had a market value of $90 per share on December 31, 2010, and they were selling for $91.50 on December 31, 2011. The earnings per share for Dunkin Company for 2011, was:

* 10,000 shares of common stock have been issued and outstanding since the company was established. They had a market value of $90 per share on December 31, 2010, and they were selling for $91.50 on December 31, 2011. The earnings per share for Dunkin Company for 2011, was:

Definitions:

Principles And Theories

Principles and theories are foundational concepts and established ideas that guide actions, hypotheses, and understanding in various fields of study or practice.

Lively Curiosity

An eager interest or enthusiasm to learn and explore.

Critical-Thinking Attitude

An approach that involves objective analysis and evaluation of an issue to form a judgment.

Caring Attitude

An approach that embodies compassion, concern, and consideration for others, showing support and understanding in a healthcare context.

Q9: A company's board of directors chooses to

Q42: The existence of the Deferred Tax Liability

Q45: A flow-through entity that holds all the

Q50: The S&P TSX Composite index delivered annual

Q73: Comprehensive income is:<br>A)used to determine net income.<br>B)used

Q82: The rate of return on net sales

Q83: A company that produces racing motorbikes has

Q118: Which of the following statements is NOT

Q119: Ongoing expenses incurred by the entity, other

Q127: Inventory turnover is calculated as:<br>A)average inventory for