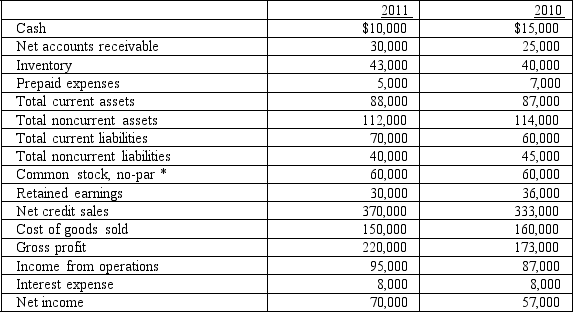

The following data represent selected information from the comparative income statement and balance sheet for Dunkin Company for the years ended December 31, 2011 and 2010:  * 10,000 shares of common stock have been issued and outstanding since the company was established. They had a market value of $90 per share on December 31, 2010, and they were selling for $91.50 on December 31, 2011. The price/earnings ratio for Dunkin Company for 2011, was:

* 10,000 shares of common stock have been issued and outstanding since the company was established. They had a market value of $90 per share on December 31, 2010, and they were selling for $91.50 on December 31, 2011. The price/earnings ratio for Dunkin Company for 2011, was:

Definitions:

Small Businesses

Companies with a limited number of employees and revenue, playing a significant role in the economy.

Black Box Influence

The impact of systems or processes whose internal workings are not visible or easily understood by outside observers.

Consumer's Mind

The perceptions, attitudes, memories, and biases that influence how a customer thinks about a product, brand, or experience.

Evoked Set

The group of brands or businesses that come to a customer’s mind when she thinks of a type of product.

Q12: Financial statement fraud can include the improper

Q35: The average annual return over the period

Q38: A statement of cash flows:<br>A)predicts future cash

Q40: Assume that a statement of cash flows

Q48: When looking at investment portfolios historically,was there

Q61: Why is the stock price of a

Q76: A firm's ability to pay current liabilities

Q80: You observe the following scatterplot of Ford's

Q116: The market value of an available-for-sale security

Q143: The Hammer Company paid $1,300,000 to purchase