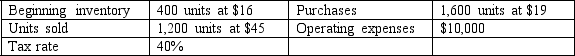

Given the following data, what would the income tax amount be if the company uses FIFO?

Definitions:

Depreciation Method

A systematic approach for allocating the cost of a tangible asset over its useful life, reflecting the asset's consumption, wear and tear, or obsolescence.

Residual Value

The estimated value that an asset will have at the end of its useful life, often considered for depreciation calculations.

Q1: Trading securities are considered to be long-term

Q6: Costs of land improvements are included in

Q14: The cost of assets acquired in a

Q84: When a company makes a journal entry

Q88: Closing entries transfer the revenue, expense, and

Q100: A bank collected $200 on behalf of

Q112: A company can use the cost-of-goods-sold formula

Q114: Trading securities are reported on the balance

Q129: Bigg and Talle Corporation uses the percent-of-sales

Q164: The rate of return on capital assets