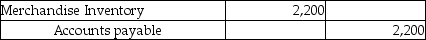

A company purchased inventory for $2,200 on account, and recorded the following journal entry:  The vendor's invoice showed terms of 3/10, n/30. Give the journal entry for the payment of the invoice seventeen days after the invoice date.

The vendor's invoice showed terms of 3/10, n/30. Give the journal entry for the payment of the invoice seventeen days after the invoice date.

Definitions:

Depreciable Assets

Assets whose cost is allocated over their useful lives through depreciation, typically tangible assets like machinery, buildings, and equipment.

Amortization

The process of gradually writing off the initial cost of an intangible asset over its useful life.

Amortization Expense

The method of incrementally expensing the original value of an intangible asset throughout its period of utility.

Straight-Line Amortization

A method of gradually writing off the nominal value of an intangible asset over its useful life in equal installments.

Q9: Thomas Company provided the following particulars for

Q11: The Service Revenue account is a temporary

Q14: Patricia Event Planning Service records prepaid expenses

Q79: Thomas Company provided the following particulars for

Q103: While recording a transaction in the cash

Q121: Gross profit is calculated as:<br>A)sales revenue less

Q127: The post-closing trial balance shows the net

Q139: Healthy Living, a diet magazine, collected $480,000

Q140: The following are the current month's balances

Q152: Under the perpetual inventory system, the journal