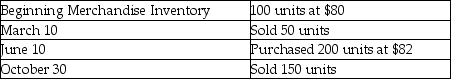

Rodriguez Company had the following balances and transactions during 2014, from January 1 to December 31:  What would the Ending Merchandise Inventory amount be as reported on the balance sheet at December 31, 2014 if the perpetual weighted-average costing method is used? (Round your intermediate calculations to two decimal places)

What would the Ending Merchandise Inventory amount be as reported on the balance sheet at December 31, 2014 if the perpetual weighted-average costing method is used? (Round your intermediate calculations to two decimal places)

Definitions:

Marginal Tax Rates

Marginal tax rates are the rates of tax applied to the next dollar of income, used to determine the tax impact of additional income or deductions.

Total Tax

The sum of all taxes levied on an individual or a corporation by various governmental agencies.

Provincial Tax Brackets

These refer to the range of income segments taxed at different rates by provincial governments in countries like Canada, where taxation powers are shared between federal and provincial authorities.

Net Working Capital

The difference between a company’s current assets and its current liabilities, indicating the liquidity of the business.

Q13: On a bank reconciliation, deposits in transit

Q28: The Income Summary account has a credit

Q29: Samson Company had the following balances and

Q41: Journal entries are required if the bank

Q63: The term "inventory," for a merchandiser, refers

Q76: Which of the following is an example

Q96: The accountant of Linda Legal Services failed

Q96: The perpetual inventory system keeps a running

Q110: Which of the following statements about internal

Q133: WAXS-D, merchandisers of musical instruments, has provided