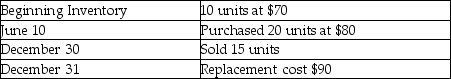

Williams Company had the following balances and transactions during 2014.  Williams maintains its records of inventory on a perpetual basis using the FIFO method. Calculate the amount of ending Merchandise Inventory at December 31, 2014 using the lower-of-cost-or-market rule.

Williams maintains its records of inventory on a perpetual basis using the FIFO method. Calculate the amount of ending Merchandise Inventory at December 31, 2014 using the lower-of-cost-or-market rule.

Definitions:

Sum-Of-The-Years-Digits

A depreciation method that results in a more accelerated write-off of assets than the straight-line method, involving adding the digits of the years of an asset's useful life.

Heavy Equipment

Large machinery used in construction, mining, and manufacturing, essential for executing large-scale tasks.

Sum-Of-The-Years-Digits

A method of accelerated depreciation where the asset’s cost is multiplied by a sequence of fractions representing the sum of the years’ digits.

Resale Value

Resale value is the expected amount that an asset or item will sell for in the future after accounting for depreciation.

Q38: GAAP requires publicly traded companies to prepare

Q44: On October 1, 2015, Android Inc. made

Q59: Check payment for $658 was incorrectly entered

Q66: A method of accounting for uncollectible receivables

Q89: Sandra Company had 200 units of inventory

Q98: The revenue, expenses, Sales Returns and Allowances

Q114: Lewis Company had the following balances and

Q116: Which of the following is a disadvantage

Q124: Michelin Jewelers uses the perpetual inventory system.

Q127: Portian Merchandisers has purchased merchandise on account