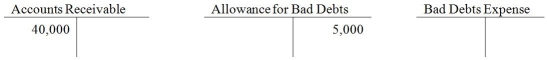

At the beginning of 2015, Peter Dots has the following ledger balances:  During the year, credit sales amounted to $800,000. Cash collected on credit sales amounted to $760,000, and $18,000 has been written off. At the end of the year, the company adjusted for bad debts expense using the percent-of-sales method and applied a rate, based on past history, of 2.5%. The ending balance of Accounts Receivable would be:

During the year, credit sales amounted to $800,000. Cash collected on credit sales amounted to $760,000, and $18,000 has been written off. At the end of the year, the company adjusted for bad debts expense using the percent-of-sales method and applied a rate, based on past history, of 2.5%. The ending balance of Accounts Receivable would be:

Definitions:

Talcott Parsons

An American sociologist known for his work on developing a general theoretical framework for the social sciences.

Paid Labor Force

Individuals who are employed and receive compensation for their work, as opposed to volunteers or unpaid domestic workers.

Normative Socialization

The process through which individuals learn and internalize the norms, values, behaviors, and social skills appropriate to their social position.

Essentialism

Is a school of thought that sees gender differences as a reflection of biological differences between women and men.

Q34: In a bank reconciliation, an NSF check

Q42: A coal mine costs $1,000,000 and is

Q78: Which of the following categories of assets

Q79: The two major types of receivables are

Q80: While counting the date of maturity of

Q84: Which of the following inventory valuation methods

Q123: Hastings Company has purchased a group of

Q126: Bison Company reported sales revenue for 2013

Q129: At the beginning of 2015, Peter Dots

Q158: Raul and Bianca are partners. Raul has