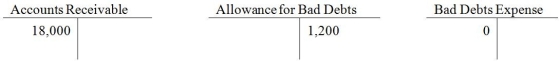

On January 1st, 2015, Everlight Corp. has the following balances:  During the year, Everlight has $150,000 of credit sales, collections of credit sales of $140,000, and write-offs of $3,000. It records bad debts expense at the end of the year using the aging-of-receivables method. At the end of the year, aging analysis produces a figure of $1,900, being the estimate of uncollectible accounts. Before the year-end entry to adjust the bad debts expense is made, the balance in the Allowance for Bad Debts expense would be:

During the year, Everlight has $150,000 of credit sales, collections of credit sales of $140,000, and write-offs of $3,000. It records bad debts expense at the end of the year using the aging-of-receivables method. At the end of the year, aging analysis produces a figure of $1,900, being the estimate of uncollectible accounts. Before the year-end entry to adjust the bad debts expense is made, the balance in the Allowance for Bad Debts expense would be:

Definitions:

Safe Harbor

Legal provisions that protect parties from liability or penalties under specific conditions if they act in good faith.

Private Securities Litigation Reform Act

A 1995 U.S. law that aims to reduce frivolous or unnecessary securities lawsuits through various procedural and substantive changes.

Financial Forecasts

Projections of a company's future income, expenses, and capital requirements, based on assumptions about economic conditions, market trends, and business operations.

Affiliate

A business enterprise located in one state that is directly or indirectly owned and controlled by a company located in another state. Also called foreign subsidiary.

Q33: The direct write-off method of accounting for

Q42: A coal mine costs $1,000,000 and is

Q43: Accounts receivable are also known as trade

Q77: Rodriguez Company had the following balances and

Q93: In a partnership, the income is taxed

Q99: Which of the following occurs when a

Q102: At the beginning of 2015, Peter Dots

Q113: Which of the following would be included

Q139: Using the last-in, first-out (LIFO)method of inventory

Q150: If a company uses the contra account,