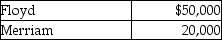

Floyd and Merriam start a partnership business on June 12, 2019. Their capital account balances as of December 31, 2020 stood as follows:  Floyd and Merriam share profits and losses equally. They agreed to dissolve the partnership and start a new one, admitting Ramelow for one-half share in the capital in exchange for land and equipment having a total market value of $70,000. Which of the following is the correct journal entry to record the introduction of Ramelow as a partner?

Floyd and Merriam share profits and losses equally. They agreed to dissolve the partnership and start a new one, admitting Ramelow for one-half share in the capital in exchange for land and equipment having a total market value of $70,000. Which of the following is the correct journal entry to record the introduction of Ramelow as a partner?

Definitions:

Babbling

The child’s first vocalizations that have the sounds of speech.

Consonants

Speech sounds produced by obstructing airflow in the vocal tract, playing a critical role in the phonetic and phonological aspects of language.

Visual Recognition

Visual recognition is the process by which the brain identifies and interprets what the eyes see, such as recognizing faces, objects, and symbols.

Stable Trait

A personality characteristic that remains consistent over time and across situations.

Q14: Trading investments are categorized in the balance

Q19: On December 31, 2015, Lopez Sales has

Q19: A contingent liability that will probably become

Q27: A net loss for the year decreases

Q47: Ben Inc. recently signed a $350,000, six-month

Q58: Whenever a partner mix in a partnership

Q72: On January 1, 2013, Davie Services issued

Q88: Smart Art is a new establishment. During

Q89: A corporation declares a dividend of $0.50

Q151: Which of the following accounts is credited