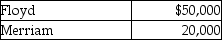

Floyd and Merriam start a partnership business on June 12, 2019. Their capital account balances as of December 31, 2020 stood as follows:  They agreed to admit Ramelow into the business for a one-third interest in the new partnership. He had to bring in a cash contribution of $20,000 for the same. Assuming that Floyd and Merriam shared profits and losses equally before the admission of Ramelow. Which of the following is the correct journal entry to record the above admission?

They agreed to admit Ramelow into the business for a one-third interest in the new partnership. He had to bring in a cash contribution of $20,000 for the same. Assuming that Floyd and Merriam shared profits and losses equally before the admission of Ramelow. Which of the following is the correct journal entry to record the above admission?

Definitions:

Problem Statement

A concise description of an issue to be addressed or a condition to be improved upon.

Objectives Document

A formal and detailed paper outlining the goals and targets of a project or plan, often used in business and strategic planning.

Statement of Scope

A document that outlines the objectives, deliverables, and boundaries of a project, specifying what is included and excluded.

Recommendations

Suggestions or advice offered with the aim of guiding decisions or actions toward a beneficial outcome.

Q25: The purchase of treasury stock:<br>A)decreases both assets

Q30: Which of the following is true of

Q38: Dolby Inc. issued a $5,000 face value,

Q54: Dana and Emile allocate 2/3 of the

Q55: The Bergan Corp. has gross pay for

Q109: Unlike in a corporation, the owners of

Q119: Which of the following liabilities is created

Q125: Which of the following is true of

Q126: Unrealized holding gains or losses on trading

Q126: Which of the following is a true