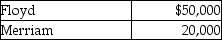

Floyd and Merriam start a partnership business on June 12, 2019. Their capital account balances as of December 31, 2020 stood as follows:  Floyd and Merriam share profits and losses equally. They agreed to dissolve the partnership and start a new one, admitting Ramelow for one-half share in the capital in exchange for land and equipment having a total market value of $70,000. Which of the following is the correct journal entry to record the introduction of Ramelow as a partner?

Floyd and Merriam share profits and losses equally. They agreed to dissolve the partnership and start a new one, admitting Ramelow for one-half share in the capital in exchange for land and equipment having a total market value of $70,000. Which of the following is the correct journal entry to record the introduction of Ramelow as a partner?

Definitions:

Closing Entries

Entries recorded at the close of an accounting period to move balances from temporary to permanent accounts.

Adjusted Trial Balance

A list of all accounts and their balances after adjusting entries are made, used to prepare financial statements and ensure the ledger accounts are balanced.

Current Assets

Assets that a company expects to convert to cash or use up within one year or the operating cycle, whichever is longer.

Property, Plant, and Equipment

Long-term or relatively permanent tangible assets such as equipment, machinery, and buildings that are used in normal business operations.

Q14: Which of the following correctly describes the

Q31: Maurice Corporation invested $100,000 to acquire 20,000

Q33: Which of the following accounting methods is

Q52: Which of the following would be included

Q58: Blanding Company issues $1,000,000 of 8%, 10-year

Q82: Garotia Company buys a building on a

Q112: In a partnership, the entry to close

Q132: The unrealized holding gains and losses on

Q141: Ross Corporation reported the following equity section

Q160: The information related to interest expense of