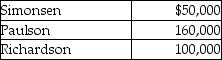

Simonsen, Paulson, and Richardson are partners in a firm with the following capital account balances:  Paulson is retiring from the partnership on December 31, 2013. The profit-and-loss-sharing ratio among Simonsen, Paulson, and Richardson is 1:3:2, in the order given. Paulson is paid $100,000 cash in full compensation for her capital account balance. Journalize the cash payment of $100,000 to Paulson upon retirement.

Paulson is retiring from the partnership on December 31, 2013. The profit-and-loss-sharing ratio among Simonsen, Paulson, and Richardson is 1:3:2, in the order given. Paulson is paid $100,000 cash in full compensation for her capital account balance. Journalize the cash payment of $100,000 to Paulson upon retirement.

Definitions:

Facial Action Coding System

A comprehensive framework for categorizing the physical manifestation of human facial expressions.

Large Research Projects

Extensive and complex investigative endeavors aimed at exploring significant academic, scientific, or commercial questions, usually requiring substantial resources and time.

Sales Tracking

The process of documenting and analyzing sales data to monitor performance and make informed business decisions.

Promotional Programs

Marketing strategies intended to increase awareness, interest, and ultimately sales of a product or service through special offers, events, or campaigns.

Q2: Glitter Services pays $1,350,000 to acquire 35%

Q7: The fair value of an investment is

Q31: On June 30, 2015, Roger Company showed

Q63: A corporation has 15,000 shares of 10%,

Q69: Occidental Produce Company has 40,000 shares of

Q86: Which of the following is true of

Q115: On May 1, 2015, Vinnie Services issued

Q120: The higher the quick ratio, the lower

Q123: Companies make a year-end adjustment to trading

Q134: When a bond is sold, the selling