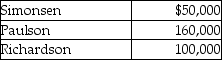

Simonsen, Paulson, and Richardson are partners in a firm with the following capital account balances:  The profit-and-loss-sharing ratio among Simonsen, Paulson, and Richardson is 1:3:2, in the order given. Paulson is retiring from the partnership on December 31, 2013. Paulson is paid $250,000 cash in full compensation for her capital account balance. Which of the following is true of the journal entry prepared at the time of retirement?

The profit-and-loss-sharing ratio among Simonsen, Paulson, and Richardson is 1:3:2, in the order given. Paulson is retiring from the partnership on December 31, 2013. Paulson is paid $250,000 cash in full compensation for her capital account balance. Which of the following is true of the journal entry prepared at the time of retirement?

Definitions:

Fair Value

The amount one would expect to get from selling an asset or the cost to transfer a liability during a regulated transaction involving parties in the market.

Directly Attributable Costs

Costs that can be directly associated with a specific asset or service, and which would not have been incurred if the asset or service had not been acquired or produced.

Financial Liability

An obligation to deliver cash or another financial asset to another entity.

Legally Enforceable Right

A right that is recognized by law and can be upheld in a court.

Q3: The units-of-production method is used to compute

Q11: The balance sheet of Ryan, James and

Q46: Baker Inc. had reported the following details

Q46: Martin Sales provides the following information: Net

Q51: Sara Digital starts the year with $2,500

Q89: An amortization schedule details each loan payment's

Q100: On January 1, 2015, Anderson Company purchases

Q103: Consolidation accounting is the way to combine

Q124: The owner of a bond or stock

Q126: In a partnership firm, if one partner