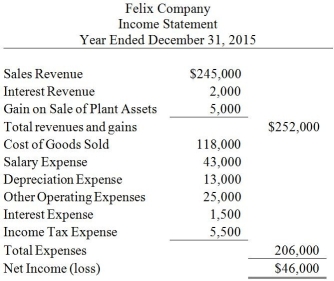

Felix Company uses the indirect method to prepare the statement of cash flows. Refer to the following income statement:  Additional information provided by the company includes the following: 1) Current assets, other than cash, increased by $24,000

Additional information provided by the company includes the following: 1) Current assets, other than cash, increased by $24,000

"2) Current liabilities decreased by $1,000

How much is the net cash provided by operating activities?"

Definitions:

Taxes Combined

A calculation that aggregates all applicable taxes (federal, state, local) on an individual or entity's income.

Effective Tax Rate

The average percentage of income paid to the government in taxes, considering all deductions and credits.

Future Value

The value of a current asset at a specified date in the future based on an assumed rate of growth over time.

Deferral of Taxes

The postponement of taxes to a future period, commonly used in retirement savings plans and investment accounts.

Q13: Cases Company issues $800,000 of 7%, 10-year

Q50: Treasury stock causes the number of:<br>A)issued shares

Q50: Melinda Machine Shop estimates manufacturing overhead costs

Q64: Sonesta Company sold equipment for cash. The

Q73: If a bond's stated interest rate is

Q93: Repair and maintenance costs for factory equipment

Q95: The Amazing Widget Company issues $500,000 of

Q111: Product costs, such as factory overhead, should

Q116: Which of the following is true of

Q147: Service companies include companies that provide health