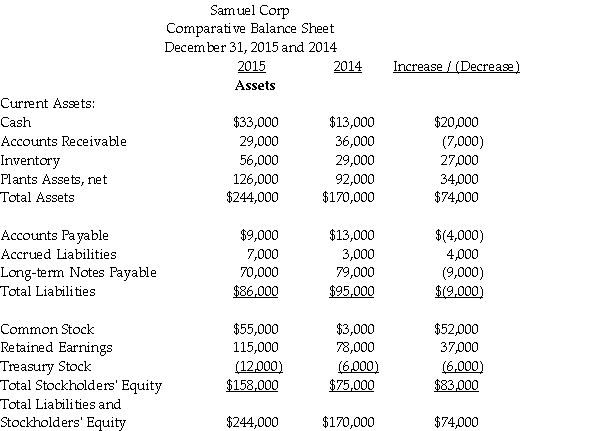

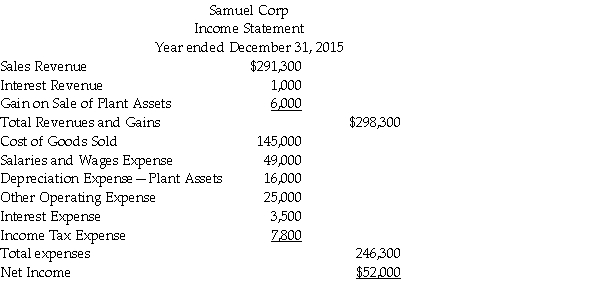

Samuel Corp. has provided the following information for the year ended December 31, 2015.

Additional information provided by the company includes the following:

Additional information provided by the company includes the following:

Equipment costing $60,000 was purchased for cash.

Equipment with a net asset value of $10,000 was sold for $16,000.

Depreciation Expense of $16,000 was recorded during the year.

During 2014, the company repaid $43,000 of Long-Term Notes Payable.

During 2014, the company borrowed $34,000 on a new Long-Term Note Payable

There were no stock retirements during the year.

There were no sales of treasury stock during the year.

All sales are on credit.

Prepare a complete statement of cash flows using the indirect method.

Definitions:

Vitamin D

A fat-soluble vitamin essential for healthy bones and immune function, obtained through sun exposure, diet, and supplements.

Sunshine

The light and warmth that come from the sun, essential for life on Earth by providing energy that supports most ecosystems.

Thrifty Genotype

Human genotype that permits efficient storage of fat to draw on in times of food shortage and conservation of glucose and nitrogen.

Glucose and Fat

Two primary sources of energy for the body, where glucose is a simple sugar and fat is composed of fatty acids and glycerol.

Q5: Jeremy Corporation estimated manufacturing overhead costs for

Q10: On January 1, 2015, Paramount Inc. issued

Q13: Days' sales in inventory is a ratio

Q15: On January 1, 2015, Carter Sales issued

Q36: Which of the following occurs when a

Q42: Orleans Company was incorporated on January 1,

Q44: A security is a share or interest

Q83: At the beginning of 2014, Conway Manufacturing

Q99: Bonds are short-term debt issued to multiple

Q143: Merchandising companies, like service companies, do not