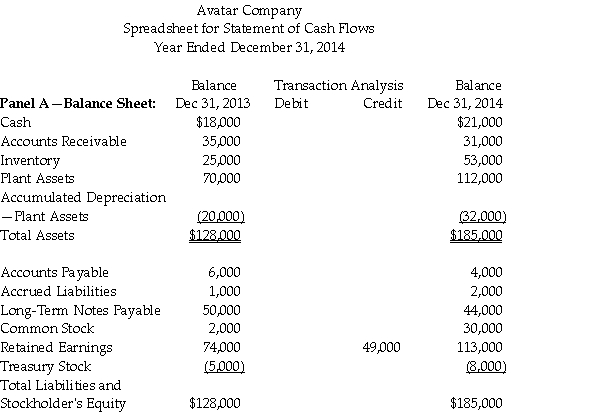

Avatar Company uses the indirect method to prepare its statement of cash flows. Using the worksheet shown below, enter the adjustments needed to record Depreciation Expense for the year of 2014 of $12,000.  Panel B-Statement of Cash Flows:

Panel B-Statement of Cash Flows:

Cash Flows From Operating Activities:

Net Income 49,000

Adjustments to Reconcile Net

Income to Net Cash Provided

by Operating Activities:

Depreciation Expense-Plant

Assets

Gain on Disposal of Plant Assets

Increase/Decrease in Accounts

Receivable

Increase/Decrease in Inventory

Increase/Decrease in Accounts

Payable

Increase/Decrease in Accrued

Liabilities

Net Cash Provided by Operating

Activities

Cash Flows from Investing Activities:

Cash Payment for Acquisition of

Plant Assets

Cash Receipt From Disposal of

Plant Assets

Net Cash Used for Investing

Activities

Cash Flows from Financing

Activities:

Cash Receipt From Issuance of

Notes Payable

Cash Payment of Notes Payable

Cash Receipt from Issuance of

Common Stock

Cash Payment for Purchase of

Treasury Stock

Cash Payment of Dividends

Net Cash Provided by

Financing Activities

Net Increase (Decrease)in Cash

Total

Definitions:

Denominator Level

In cost accounting, it refers to the base level of activity or volume used to calculate fixed costs per unit.

Standard Hours

The expected amount of time it should take to complete a task or process under normal conditions.

Target Denominator Level

A predetermined level of activity (such as machine-hours or labor-hours) used to allocate fixed overhead costs to individual units of production.

Volume Variance

A metric that measures the difference between the budgeted and actual volume of production or sales, often reflecting changes in demand or efficiency.

Q3: Rodriguez Inc. uses the indirect method to

Q5: Landess Corporation currently has 120,000 shares outstanding

Q29: Greg Financial Services invested $15,000 to acquire

Q33: Gordon Corporation reported the following equity section

Q46: In a process costing system, a department's

Q62: Fogelin Promotional Services uses a job order

Q66: Selling and administrative expenses are subtracted from

Q81: Repair and maintenance costs of vehicles used

Q96: On March 1, 2015, Vinnie Services issued

Q98: Organic Sugar Company at Ohio has six