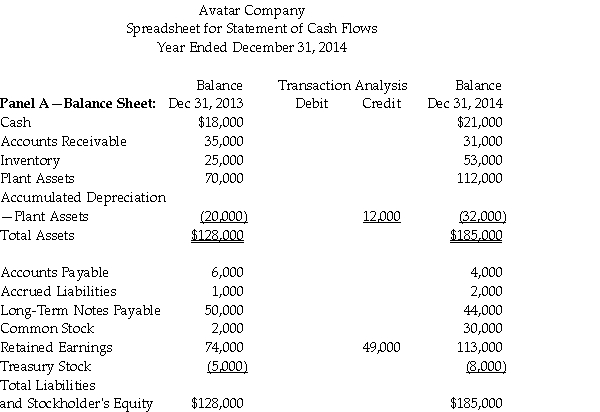

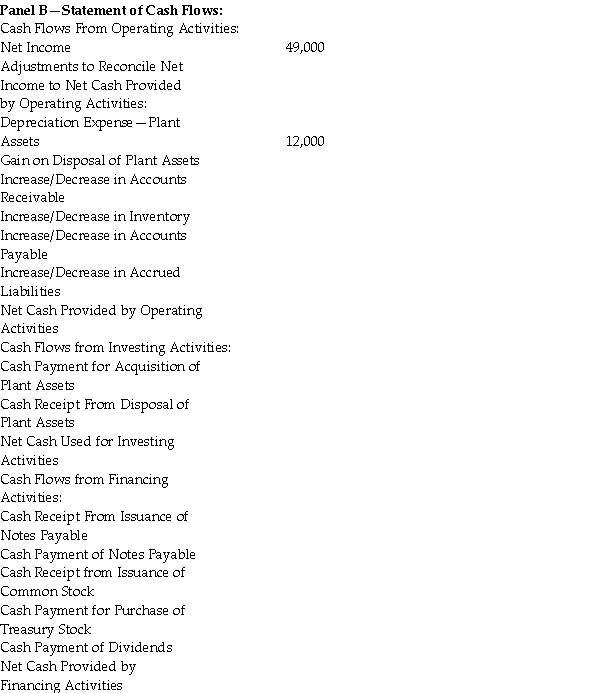

Avatar Company uses the indirect method to prepare its statement of cash flows. During 2014, plant assets with book value of $10,000(cost $10,000 and accumulated depreciation $0)were sold for $14,000. Using the worksheet shown below, enter the adjustments needed to record the sale of plant assets and gain on sale of plant assets of $4,000.

Net Increase (Decrease)in Cash

Net Increase (Decrease)in Cash

Total

Definitions:

Market System

A system of economics where the choices about investment, production, and distribution rely on the principles of supply and demand, and the pricing of goods and services is established freely in the market.

Business Risk

The potential for losses or less than expected returns stemming from the operational aspects of a business.

Macroeconomy

The study of the performance, structure, and behavior of an economy as a whole, including total national income, GDP, and inflation rates.

Market System

A financial structure in which the choices about investment, production, and allocation are directed by the pricing cues generated by supply and demand dynamics.

Q6: Shield Company just started in business, and

Q31: A corporation has 2,000 shares, 10% preferred

Q50: On December 31, 2013, Clark Sales has

Q72: Which of the following best describes horizontal

Q74: If bonds with a face value of

Q77: Held-to-maturity investments applies only to debt securities

Q80: Altima Company finished Job A40 on the

Q98: When a company invests in a bond

Q109: On June 30, Coral Company finished Job

Q153: Which of the following correctly describes just-in-time