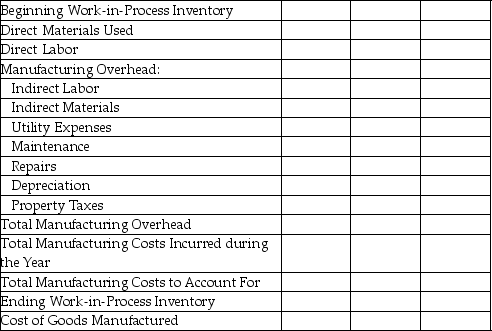

Opal Company used $213,000 of direct materials and incurred $111,000 of direct labor costs during 2015. Indirect labor amounted to $8,100 while indirect materials used totaled $4,800. Other operating costs pertaining to the factory included utilities of $9,300; maintenance of $13,500; repairs of $5,400; depreciation of $23,700; and property taxes of $7,800. There was no beginning or ending finished goods inventory. The Work-in-Process Inventory account reflected a balance of $16,500 at the beginning of the period and $22,500 at the end of the period.

Required: Prepare a schedule of cost of goods manufactured for Opal Company using the format below.

COST OF GOODS MFGD

Definitions:

Carrying Costs

Expenses incurred by holding inventory or assets, including storage, insurance, and taxes.

Product Demand

Refers to the desire and necessity for consumers to purchase a specific good or service.

Carrying Cost

Costs incurred by holding inventory, including storage, insurance, and opportunity costs, over a specific period.

Credit Sales

Credit sales are transactions where the purchase of goods or services is made on credit, with payment to be made at a later date.

Q79: In manufacturing, the cost objects are often

Q97: For a manufacturer, rent paid for an

Q99: Under the first-in, first-out (FIFO)method, the cost

Q100: Allen Services purchased 20 delivery vehicles by

Q102: Which of the following is included in

Q119: A parent company is a company that:<br>A)is

Q122: While preparing a statement of cash flows

Q126: Financial accounting prepares reports for internal purposes,

Q132: The fixed costs per unit will:<br>A)increase as

Q137: Total manufacturing costs to account for during