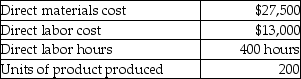

Irene Manufacturing uses a predetermined overhead allocation rate based on percentage of direct labor cost. At the beginning of 2014, Irene estimated total manufacturing overhead costs at $1,050,000 and total direct labor costs at $840,000. In June, 2014, Job 711 was completed. Job stats are as follows:  How much was the cost per unit of finished product?

How much was the cost per unit of finished product?

Definitions:

Government Intervention

Regulatory actions taken by a government in order to affect decisions made by individuals, groups, or organizations within its economic systems.

Excludable

A characteristic of a good or service that allows the owner or provider to prevent others from using it without permission.

Rival

A characteristic of a good or service that implies its consumption by one individual prevents simultaneous consumption by another individual.

Public Goods

Public goods are commodities or services that are provided without profit to all members of a society, either by the government or a private individual or organization.

Q40: Diemans Corp. has provided a part of

Q42: Atlantis Inc. reported the following data: <img

Q55: The budgeted production of Gunix Inc. is

Q77: The trend analysis report of Doppler Inc.

Q81: Farmerlands Enterprises has budgeted sales for the

Q81: LDR Manufacturing produces a pesticide chemical and

Q93: The purpose of managerial accounting is to

Q111: The direct material budget is prepared on

Q121: Under the first-in, first-out (FIFO)method, the current-period

Q132: Under a process costing system, direct labor