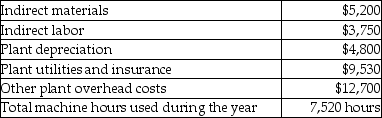

Happy Clicks Inc. uses a predetermined overhead allocation rate of $4.75 per machine hour. Actual overhead costs incurred during the year are as follows:  What is the amount of manufacturing overhead cost allocated to Work-in-Process Inventory during the year?

What is the amount of manufacturing overhead cost allocated to Work-in-Process Inventory during the year?

Definitions:

Grandmother Hypothesis

A theory positing that the presence and assistance of post-menopausal women, especially grandmothers, can significantly increase the survival rates of their grandchildren, thereby influencing human evolution.

Life-history Hypothesis

A theory that explains how natural selection operates on traits that affect an organism's life cycle, such as reproductive timing, growth, and survival.

Mean Reproductive Spans

The average duration between an individual's first and last reproductive events within a population.

Fitness Payoffs

Benefits in terms of reproductive success or survival that result from a specific trait or behavior in an organism, central to the concept of natural selection.

Q12: The cost of goods manufactured is recorded

Q53: Evanston Manufacturing Company reported the following information

Q64: When the selling price per unit decreases,

Q81: Repair and maintenance costs of vehicles used

Q100: Allen Services purchased 20 delivery vehicles by

Q108: Period costs are the:<br>A)current assets and liabilities

Q110: Fixed costs divided by contribution margin per

Q118: If a business operates in an industry

Q144: The contribution of equipment by a stockholder

Q153: Which of the following transactions would be