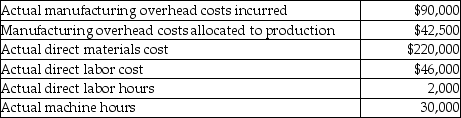

Felton Quality Productions uses a predetermined overhead allocation rate based on machine hours. It has provided the following information for the year 2014:  Based on the above information, calculate the manufacturing overhead rate applied by Felton.

Based on the above information, calculate the manufacturing overhead rate applied by Felton.

Definitions:

Chilopods

A class of arthropods commonly known as centipedes, characterized by elongated bodies and a pair of legs per body segment.

Arachnids

Eight-legged arthropods, such as spiders, scorpions, ticks, and mites.

True Coelom

A body cavity completely lined by mesoderm, found in most multicellular animals, facilitating the development of more complex structures.

Open Circulatory System

A type of circulatory system in which the blood bathes the tissues directly; characteristic of arthropods and many mollusks. Compare with closed circulatory system.

Q8: Which of the following is true of

Q16: A textile manufacturing company is most likely

Q25: Donald Corp. reported the following on its

Q33: For a manufacturing firm, which of the

Q47: The balance sheet of a _ company

Q54: Service companies do not have product costs

Q63: Which of the following is a variable

Q75: Evans Company has estimated the following amounts

Q77: Unlike merchandising companies, income statements of service

Q78: The following information relates to Webster Inc.: