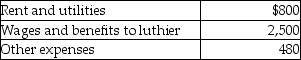

Colin was a professional classical guitar player until his motorcycle accident that left him disabled. After long months of therapy, he hired an experienced luthier (maker of stringed instruments) and started a small shop to make and sell Spanish guitars. The guitars sell for $700 and the fixed monthly operating costs are as follows:  Colin's accountant told him about contribution margin ratios and he understood clearly that for every dollar of sales, $0.60 went to cover his fixed costs, and that anything past that point was pure profit. Colin is planning to increase the selling price to $750. What impact will the increase in selling price have on the contribution margin ratio?

Colin's accountant told him about contribution margin ratios and he understood clearly that for every dollar of sales, $0.60 went to cover his fixed costs, and that anything past that point was pure profit. Colin is planning to increase the selling price to $750. What impact will the increase in selling price have on the contribution margin ratio?

Definitions:

Tax Rate

The specified percentage of incomes that the government earmarks for collection from individuals or corporations as taxes.

Net Income

The total earnings of a company after subtracting all expenses and taxes.

Retained Earnings

Profits that a company decides to keep or reinvest in the business after dividends have been paid out to shareholders, reflecting ongoing financial health and potential for growth.

Net Income

The ultimate financial gain of a company after expenses and taxes are deducted from its total revenue.

Q7: The Assembly Department of Smart Computers had

Q16: Which of the following will be debited

Q70: Standard costs are developed by the cooperative

Q72: The product line of a manufacturing company

Q79: During 2015, a company incurred $500,000 of

Q93: Dora Travel Services provided the following information:<br>Cost

Q108: Jacob Company incurred $7,000 for indirect labor

Q127: Under process costing, the total production costs

Q127: Communicating the expectations of top management to

Q168: Kevin Company prepared the following static budget