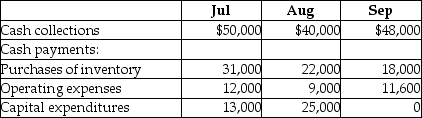

A3+ has prepared its 3rd quarter budget and provided the following data:  The cash balance on June 30 is projected to be $4,000. The company has to maintain a minimum cash balance of $5,000 and is authorized to borrow at the end of each month to make up any shortfalls. It may borrow in increments of $5,000 and has to pay interest every month at an annual rate of 5%. All financing transactions are assumed to take place at the end of the month. The loan balance should be repaid in increments of $5,000 whenever there is surplus cash. Calculate the ending cash balance before financing for August.

The cash balance on June 30 is projected to be $4,000. The company has to maintain a minimum cash balance of $5,000 and is authorized to borrow at the end of each month to make up any shortfalls. It may borrow in increments of $5,000 and has to pay interest every month at an annual rate of 5%. All financing transactions are assumed to take place at the end of the month. The loan balance should be repaid in increments of $5,000 whenever there is surplus cash. Calculate the ending cash balance before financing for August.

Definitions:

Risk-Averse

Describes individuals who choose to reduce risk when that reduction leaves the expected value of their income or wealth unchanged.

Income Curve

The income curve, in economics, typically relates to a graphical representation showing how a change in income affects consumption or purchasing patterns of individuals or households.

Expected Value

A statistical concept that calculates the average result of a random event when the process is repeated many times.

Double or Nothing

A gamble or risk in which a person has the chance to either double their money or lose it all.

Q15: Both job order costing and process costing

Q29: Which of the following costs is considered

Q30: On June 30, Caroline Company finished Job

Q74: Pitt Jones Company had the following activities,

Q79: Centralized operations are better for small companies

Q106: Components of the master budget are: the

Q107: A company is analyzing its month-end results

Q116: Anthony Company's highest point of total cost

Q129: Pitt Jones Company had the following activities,

Q141: Fogelin Promotional Services uses a job order