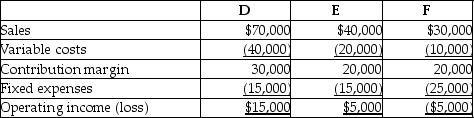

Macaulay Company has three product lines-D, E, and F. The following information is available:  Macaulay Company is thinking of dropping product line F because it is reporting an operating loss. Assuming fixed costs are unavoidable, if Macaulay Company drops product line F, and rents the space formerly used to produce product F for $17,000 per year, total income will be:

Macaulay Company is thinking of dropping product line F because it is reporting an operating loss. Assuming fixed costs are unavoidable, if Macaulay Company drops product line F, and rents the space formerly used to produce product F for $17,000 per year, total income will be:

Definitions:

Hedge Funds

Investment funds that use various strategies to earn active returns for their investors, often employing leverage and derivatives.

Mortgage Market Meltdown

A significant downturn in the mortgage market, often resulting from a large number of loan defaults and the devaluation of mortgage-backed securities.

Securitization

The process of transforming illiquid assets into a tradable form by converting them into securities.

Private Equity

Capital investments made into companies that are not publicly traded, often to finance growth, acquisitions, or restructuring.

Q3: Mountain Sports Equipment Company projected sales of

Q9: The payback method and the accounting rate

Q16: Which of the following describes the term

Q21: Which of the following is an example

Q24: The Sarbanes-Oxley Act does not allow CPA

Q28: Freightcan Holders has provided the following extracts

Q53: The accounting rate of return method of

Q68: Canbera Company is considering investing $450,000 in

Q115: Unfavorable variances are subtracted from each other

Q122: Compound interest used in discounted cash flow