John wins the lottery and has the following three payout options for after-tax prize money: 1. $150,000 per year at the end of each of the next six years

2. $300,000 (lump sum) now

3. $500,000 (lump sum) six years from now

The required rate of return is 9%. What is the present value if he selects the first option? Round to nearest whole dollar.

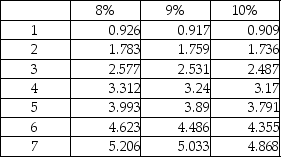

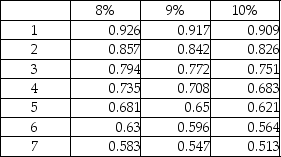

Present value of annuity of $1:  Present value of $1:

Present value of $1:

Definitions:

Issue Price

The price at which securities, such as bonds or shares, are originally sold to the public or investors by the issuing entity.

Installment Note Payable

A debt instrument that requires a series of periodic payments to the lender over a specified period of time.

Interest Expense

The expenditure an entity incurs from borrowing funds during a certain period.

Notes Payable

Written agreements in which one party promises to pay another party a definite sum of money either on demand or at a specified future date.

Q6: Valuable Electronics uses a standard part in

Q15: Which of the following would not be

Q30: The AICPA offers a designation of Chartered

Q39: Centric Sail Makers manufacture sails for sailboats.

Q39: Delicious Food Products is famous for their

Q42: Which of the following two methods are

Q83: Gamma Company is considering an investment of

Q112: Managers who follow the management by exception

Q169: Managerial accounting develops reports that help internal

Q214: Use the appropriate letter(s)to indicate if the