John wins the lottery and has the following three payout options for after-tax prize money: 1. $50,000 per year at the end of each of the next six years

2. $300,000 (lump sum) now

3. $500,000 (lump sum) six years from now

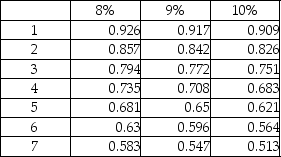

The required rate of return is 9%. What is the present value if he selects the third option? Round to nearest whole dollar.

Present value of $1:

Definitions:

Abnormal Blood Flow

A condition where the circulation of blood through the body's vessels occurs at an irregular rate or volume, potentially leading to health issues.

Synesthesia

A neurological condition where stimulation of one sensory or cognitive pathway leads to involuntary experiences in a second sensory or cognitive pathway.

Barbiturates

A class of drugs acting as central nervous system depressants, traditionally used for anesthesia, sedation, and as anticonvulsants.

THC

Tetrahydrocannabinol, the psychoactive compound found in cannabis that is responsible for its intoxicating effects.

Q7: Which of the following is one of

Q8: Which of the following would NOT be

Q45: A market-based transfer price considers the _

Q70: The balance sheet of a service company

Q86: Which of the following is the last

Q88: Cost of goods manufactured reflects<br>A)goods sold during

Q107: At the internal rate of return (IRR),

Q157: The management of Delta Company has calculated

Q188: Happy Feet Running Company manufactures running shoes

Q191: Over the long-term, all costs are uncontrollable.