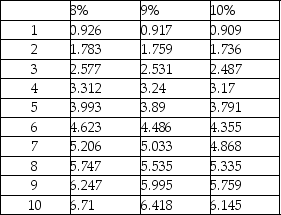

A company is considering an iron ore extraction project which requires an initial investment of $500,000 and will yield annual cash flows of $150,000 for 4 years. The company's hurdle rate is 9%. What is the NPV of the project?

Definitions:

Q15: Emerald Marine Stores Company manufactures decorative fittings

Q29: Victory Company makes a special kind of

Q34: Payback provides management with valuable information about

Q50: Following details are provided by VPN Company.

Q55: Managerial accountants must comply with Generally Accepted

Q72: The following details are provided by Dopler

Q124: The fixed overhead volume variance is a

Q128: Emerald Marine Stores Company manufactures decorative fittings

Q139: Movements toward sustainability and corporate responsibility often<br>A)result

Q144: A company is setting its direct materials