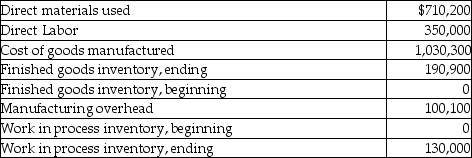

Youngstown Rubber reports the following data for its first year of operation.  What are the total manufacturing costs to account for?

What are the total manufacturing costs to account for?

Definitions:

Gross Pay

The total amount of salary or wages earned by an employee before any deductions are made for taxes and other withholdings.

Take-Home Pay

The amount of income left after deductions like taxes and social security contributions are subtracted from the gross salary.

Federal Income Tax

The tax levied by the U.S. government on the annual earnings of individuals, corporations, trusts, and other legal entities.

Allowances

Reductions from the gross amount due to defects or allowances for customer discounts, contributing to the net sales figure.

Q6: Arriyana has just received an inheritance of

Q6: The Manufacturing Overhead account is credited for

Q22: A company is deciding whether to purchase

Q28: How is the cost of indirect materials

Q56: The "triple bottom line" focuses on what

Q82: Gamma Company is considering an investment opportunity

Q129: All of the following are considered fixed

Q172: Job 450 requires $10,500 of direct materials,

Q181: Zanny Moldings has the following estimated costs

Q210: The predetermined manufacturing overhead rate is calculated