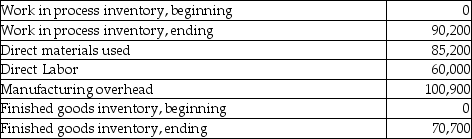

Fit Apparel Company reports the following data for its first year of operation.  What are the total manufacturing costs to account for?

What are the total manufacturing costs to account for?

Definitions:

Naltrexone

A medication primarily used in the management of alcohol dependence and opioid dependence.

Alcohol Use Disorder

A health issue characterized by an inability to control or stop alcohol consumption, in spite of facing serious negative consequences in social settings, at work, or health-wise.

Neurotransmitters

Chemicals that transmit signals across a neural synapse between neurons, playing a crucial role in the body's response systems.

Metabolizes Alcohol

The process by which the body chemically breaks down alcohol, primarily in the liver, by enzymes such as alcohol dehydrogenase.

Q17: Job order costing would most likely be

Q50: Here are selected data for Boston Bracing

Q54: The plantwide overhead cost allocation rate is

Q78: The payback method is the most thorough

Q107: Widget Maker Manufacturing uses job costing. In

Q112: A _ is used to accumulate the

Q163: A(n)_ is an estimated manufacturing overhead rate

Q196: Which of the following is not an

Q222: A _ is the primary factor that

Q255: Crane Fabrication allocates manufacturing overhead to each