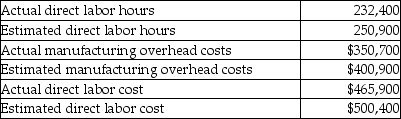

Nadal Company is debating the use of direct labor cost or direct labor hours as the cost allocation base for allocating manufacturing overhead. The following information is available for the most recent year:  If Nadal Company uses direct labor hours as the allocation base, what would the allocated manufacturing overhead be for the year? (Round intermediary calculations to the nearest cent and the final answer to the nearest dollar.)

If Nadal Company uses direct labor hours as the allocation base, what would the allocated manufacturing overhead be for the year? (Round intermediary calculations to the nearest cent and the final answer to the nearest dollar.)

Definitions:

Dividend Income Distributions

These are payments made by a corporation to its shareholders, usually derived from the company's earnings.

Capital Gains

The increase in value of an asset or investment above its purchase price, realized when the asset is sold.

NAV

Net Asset Value (NAV) represents the per-share market value of all the securities held by a mutual fund, ETF, or similar investment vehicle, calculated by subtracting the fund's liabilities from its assets and dividing by the number of shares outstanding.

Income Distributions

Payments made to investors from the income generated by the assets within a fund or investment, such as dividends or interest payments.

Q30: Hilltop Manufacturing uses a predetermined manufacturing overhead

Q119: Beaver Company manufactures coffee tables and uses

Q128: Unit-level activities and costs are incurred for

Q130: An example of a prevention cost is

Q143: Platinum Company manufactures several different products and

Q147: The Sweetheart Corporation uses departmental overhead rates

Q190: When a company has established separate manufacturing

Q205: A company has monthly fixed costs of

Q284: Country Furniture Company manufactures furniture at its

Q308: Selected information regarding a company's most recent