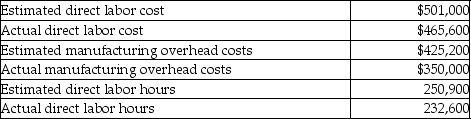

Quick Step Company is debating the use of direct labor cost or direct labor hours as the cost allocation base for allocating manufacturing overhead. The following information is available for the most recent year:  If Quick Step Company uses direct labor cost as the allocation base, what would the predetermined manufacturing overhead rate be?

If Quick Step Company uses direct labor cost as the allocation base, what would the predetermined manufacturing overhead rate be?

Definitions:

Corporate Income Taxes

Taxes imposed on the net income (profits) of corporations by the government.

Property Taxes

Government-imposed charges on property, calculated from the real estate's worth, intended to finance community facilities and public infrastructure.

Payroll Taxes

Payroll Taxes are taxes imposed on employers or employees, and are usually calculated as a percentage of the salaries that employers pay their staff.

Local Finance

Financial activities, policies, and management practices that pertain to local government units, including budgeting, revenue collection, and expenditure.

Q2: ABM stands for<br>A)activity-based management.<br>B)all but managers.<br>C)activity-based manufacturing.<br>D)activity

Q49: Companies that use departmental overhead rates trace

Q83: The cost of lighting the factory would

Q117: The total cost of a cost object

Q132: Facility-level activities and costs are incurred no

Q135: Zanny Moldings has the following estimated costs

Q181: In recent years, there has been an

Q189: Direct costs for one cost object will

Q190: On the line in front of each

Q326: The journal entry needed to record the