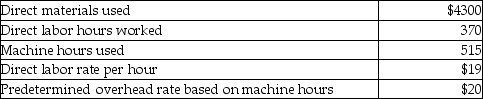

Cooper's Company manufactures custom engines for use in the lawn and garden equipment industry. The company allocates manufacturing overhead based on machine hours. Selected data for costs incurred for Job 798 are as follows:  What is the total manufacturing cost of Job 798?

What is the total manufacturing cost of Job 798?

Definitions:

Acquisition Differential

The difference between the purchase price of an acquired company and the sum of its net assets' fair values.

Retained Earnings

The portion of a company's profit not distributed to shareholders as dividends but kept in the company to reinvest in its core business or to pay debt.

Cost Method

An accounting approach for investments, outlining that an investment is recorded at its acquisition cost, adjusting for any dividends received.

Deferred Tax Asset

An accounting term representing an asset that may be used to reduce any future tax liability originating from temporary timing differences between the accounting and tax treatment of transactions.

Q10: Where would period costs be found on

Q51: Poland's Paints allocates overhead based on machine

Q84: For a manufacturer, beginning work in process

Q128: Unit-level activities and costs are incurred for

Q159: Sunk costs are irrelevant to the decision

Q178: Non-value-added activities include all of the following

Q220: Job costing systems accumulate the costs for

Q251: Which of the following is an example

Q266: Determining how much manufacturing overhead is overallocated

Q315: Lucky Cow Dairy provided the following expense