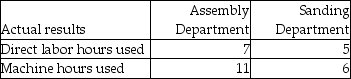

Lucas Industries uses departmental overhead rates to allocate its manufacturing overhead to jobs. The company has two departments: Assembly and Sanding. The Assembly Department uses a departmental overhead rate of $50 per machine hour, while the Sanding Department uses a departmental overhead rate of $25 per direct labor hour. Job 603 used the following direct labor hours and machine hours in the two departments:  The cost for direct labor is $25 per direct labor hour and the cost of the direct materials used by Job 603 is $1600.

The cost for direct labor is $25 per direct labor hour and the cost of the direct materials used by Job 603 is $1600.

How much manufacturing overhead would be allocated to Job 603 using the departmental overhead rates?

Definitions:

Bad Debt Expense

Bad debt expense represents the amount of receivables that a company cannot collect, considered a business expense.

Sales Tax

A government-imposed levy on the sale of goods and services, contributing to public revenue.

Allowance Method

An accounting technique used to manage accounts receivable and bad debts by estimating uncollectible accounts.

GAAP

Generally Accepted Accounting Principles, a set of accounting standards and practices used in the United States to ensure the accuracy and consistency of financial reporting.

Q4: Digital Technologies manufactures three types of computers

Q71: In a particular department, 8200 units were

Q111: Costs that remain the same among alternatives

Q209: During a period,43,200 units were completed and

Q210: A system that focuses on activities as

Q230: An example of a fixed cost would

Q237: Weekly Company gathered the following information for

Q265: Here is some basic data for Honey

Q273: Before the year began, Butler Manufacturing estimated

Q330: Shirley Enterprises uses job costing. Actual overhead