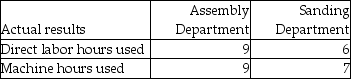

Lucas Industries uses departmental overhead rates to allocate its manufacturing overhead to jobs. The company has two departments: Assembly and Sanding. The Assembly Department uses a departmental overhead rate of $60 per machine hour, while the Sanding Department uses a departmental overhead rate of $30 per direct labor hour. Job 603 used the following direct labor hours and machine hours in the two departments:  The cost for direct labor is $35 per direct labor hour and the cost of the direct materials used by Job 542 is $1500.

The cost for direct labor is $35 per direct labor hour and the cost of the direct materials used by Job 542 is $1500.

What was the total cost of Job 542 if Lucas Industries used the departmental overhead rates to allocate manufacturing overhead?

Definitions:

Jeopardy

A situation involving exposure to danger or risk, often used in the context of legal vulnerability or the potential loss of something valuable.

Discrimination

Unjust or prejudicial treatment of different categories of people, especially on the grounds of race, age, or sex.

Job-relevant

Criteria or information that is directly pertinent to the performance of a specific job role.

Equal Employment Opportunity

A principle that ensures all individuals have the same chance for employment, regardless of race, color, religion, sex, or national origin.

Q21: Which of the following is not a

Q54: Nadal Company is debating the use of

Q74: Two main benefits of ABC are (1)more

Q90: Sunnyside Orchards, a juice manufacturer, uses a

Q96: The "total physical units accounted for" is

Q122: The document many process costing companies use

Q124: At a service company, the indirect costs

Q125: Which costs comprise WIP Inventory on a

Q210: A system that focuses on activities as

Q239: Actual manufacturing overhead is always recorded<br>A)with a