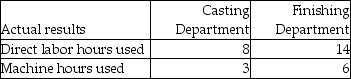

Crane Fabrication allocates manufacturing overhead to each job using departmental overhead rates. Crane's operations are divided into a metal casting department and a metal finishing department. The casting department uses a departmental overhead rate of $51 per machine hour, while the finishing department uses a departmental overhead rate of $25 per direct labor hour. Job A216 used the following direct labor hours and machine hours in the two departments:  The cost for direct labor is $42 per direct labor hour and the cost of the direct materials used by Job A216 is $2000.

The cost for direct labor is $42 per direct labor hour and the cost of the direct materials used by Job A216 is $2000.

What was the total cost of Job A216 if Crane Fabrication used the departmental overhead rates to allocate manufacturing overhead?

Definitions:

Break-Even Point

The moment when the sum of all expenses matches the sum of all income, resulting in neither a profit nor a loss.

Revenue

The total income generated from the sale of goods or services related to a company's primary operations.

Break-Even Point

The stage at which total costs and total revenues are exactly equal, meaning no profit nor loss is being made, having no net effect on the financial position.

Break-Even Volume

The quantity of goods or services sold at which total revenues equal total costs, resulting in neither profit nor loss.

Q67: Which of the following cost of quality

Q71: OP Technologies Manufacturing manufactures small parts and

Q90: The Sit-N-Spin Corporation manufactures and assembles office

Q112: A _ is used to accumulate the

Q121: Variable costs per unit decrease as production

Q134: The predetermined manufacturing overhead rate is calculated

Q184: The cost of direct labor used in

Q201: Potter & Weasley Company had the following

Q223: The following account balances at the beginning

Q242: In a department, 28,000 units are completed