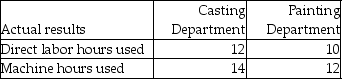

The Sweetheart Corporation uses departmental overhead rates to allocate its manufacturing overhead to jobs. The company has two departments: cutting and painting. The Cutting Department uses a departmental overhead rate of $12 per machine hour, while the Painting Department uses a departmental overhead rate of $17 per direct labor hour. Job 422 used the following direct labor hours and machine hours in the two departments:

The cost for direct labor is $20 per direct labor hour and the cost of the direct materials used by Job 422 is $800.

The cost for direct labor is $20 per direct labor hour and the cost of the direct materials used by Job 422 is $800.

Required: What was the total cost of Job 422 if the Sweetheart Corporation used the departmental overhead rates to allocate manufacturing overhead?

Definitions:

Stock Price

The cost of purchasing a share of a company, which fluctuates based on supply and demand, company performance, and market conditions.

American Call Option

A type of options contract that gives the holder the right, but not the obligation, to buy a specified asset at a specified price on or before a specified date.

Risk-Free Interest Rate

The rate of return on an investment with no risk of financial loss, typically represented by the yield on government securities.

Exercise Price

The price at which an option holder can buy (call) or sell (put) the underlying asset.

Q16: The journal entry to record the use

Q27: How is the cost of indirect materials

Q38: The total cost of a job shown

Q56: Big Trail Running Company has started to

Q95: Regarding activity-based costing systems, which of the

Q97: The eight wastes of traditional operations includes

Q145: When units are transferred from Processing Department

Q158: Tina's Interior Design expects its designers will

Q247: The total cost of a job shown

Q285: How do you calculate the predetermined manufacturing