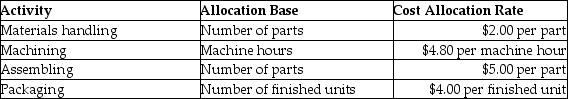

Beaver Company manufactures coffee tables and uses an activity-based costing system to allocate all manufacturing conversion costs. Each coffee tables consists of 40 separate parts totaling $280 in direct materials, and requires 6.0 hours of machine time to produce. Additional information follows:  What is the cost of assembling per coffee table?

What is the cost of assembling per coffee table?

Definitions:

Conversion Costs

The sum of labor and overhead costs incurred to convert raw materials into finished goods.

Weighted-Average Method

A cost accounting method that calculates the cost of units produced during a period based on the weighted average of the costs of units available for sale or use.

Processing Department

A division within a factory where a specific stage of production is completed, typically involving a series of operations or processes.

Cost Transferred

The movement of accumulated costs from one cost center to another in the accounting period.

Q51: Poland's Paints allocates overhead based on machine

Q55: Average variable costs<br>A)remain the same as production

Q57: On a production cost report, where would

Q78: Columbia Corporation manufactures two products: Tricycles and

Q210: The predetermined manufacturing overhead rate is calculated

Q213: Garrison Company adds direct materials at the

Q251: Wadsworth Industries manufactures small appliances and uses

Q301: Spruce Company uses a job costing system.

Q316: How is the cost of direct materials

Q332: Here are selected data for Wilson Company: