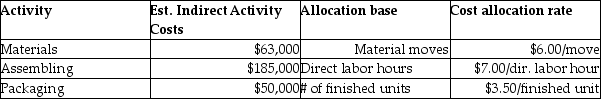

Beartowne Enterprises uses an activity-based costing system to assign costs in its auto-parts division.  The following units were produced in December with the following information:

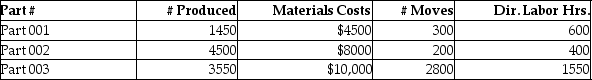

The following units were produced in December with the following information: Total manufacturing costs for Part 003 is

Total manufacturing costs for Part 003 is

Definitions:

Investing Activities Section

Part of the cash flow statement that shows the cash spent on and received from investments in assets, loans, and other business activities.

Book Value

The value of an asset as recorded on a company’s balance sheet, representing the cost of the asset minus accumulated depreciation.

Gain

An increase in equity resulting from the sale of an asset for more than its purchase price or carrying value, not related to the company's primary operations.

Accounts Receivable

Represents money owed to a company by its clients or customers for goods or services that have been delivered or used but not yet paid for.

Q39: Satellite Manufacturing is a company that manufactures

Q61: Alexander Inc. uses activity-based costing. The company

Q88: If a job consists of a batch

Q110: Darlington & Myrtle, Attorneys at Law, provide

Q110: Total fixed costs for Randolph Manufacturing are

Q143: Platinum Company manufactures several different products and

Q145: A service firm's costs are comprised of

Q214: If all direct materials are added at

Q238: Before the year began, Butler Manufacturing estimated

Q306: Poland's Paints allocates overhead based on machine