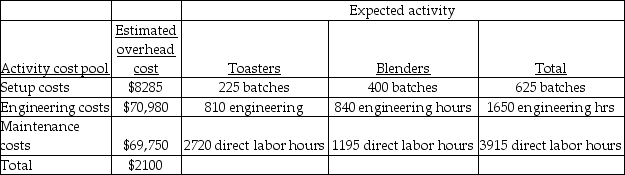

Vandalay Industries manufactures two products: toasters and blenders. The annual production and sales of toasters is 2100 units, while 1500 units of blenders are produced and sold. The company has traditionally used direct labor hours to allocate its overhead to products. Toasters require 1.25 direct labor hours per unit, while blenders require .75 direct labor hours per unit. The total estimated overhead for the period is $149,015. The company is looking at the possibility of changing to an activity-based costing system for its products. If the company used an activity-based costing system, it would have the following three activity cost pools:  The predetermined overhead allocation rate using the traditional costing system would be closest to

The predetermined overhead allocation rate using the traditional costing system would be closest to

(Round all answers to two decimal places.)

Definitions:

Q1: When units are moved from one processing

Q11: Hopscotch Limited, a manufacturer of a variety

Q18: What type of costs are incurred to

Q63: The use of which of the following

Q162: When the last process of the product

Q180: Variable costs are described by which of

Q189: Yummy Tummy Desserts has 3100 quarts of

Q204: Telecom uses activity-based costing to allocate all

Q281: Payroll-related costs for factory employees who do

Q321: Bob Burgers allocates manufacturing overhead to jobs