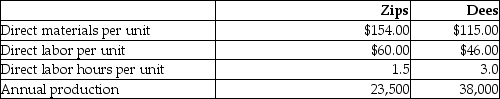

Cross Roads Manufacturing currently uses a traditional costing system. The company allocates overhead to its two products, Zips and Dees, using a predetermined manufacturing overhead rate based on direct labor hours. Here is data related to the company's two products:  Information about the company's estimated manufacturing overhead for the year follows:

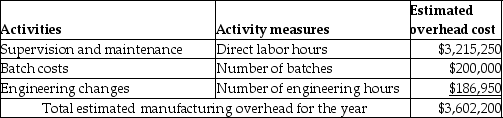

Information about the company's estimated manufacturing overhead for the year follows: Total estimated direct labor hours for the company for the year are 149,250 hours.

Total estimated direct labor hours for the company for the year are 149,250 hours.

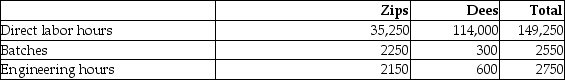

The company is evaluating whether it should use an activity-based costing system in place of its traditional costing system. Additional information about production needed for the activity-based costing system follows: The amount of manufacturing overhead that would be allocated to one unit of Dees using an activity-based costing system would be closest to (Round all answers to two decimal places.)

The amount of manufacturing overhead that would be allocated to one unit of Dees using an activity-based costing system would be closest to (Round all answers to two decimal places.)

Definitions:

Salary

Compensation received by an employee, usually as periodic payments, for performing their job responsibilities.

Bonuses

Additional compensation given to employees as an incentive or reward for their performance and contribution to the organization.

Incentive Plans

Programs designed to motivate and reward employees for achieving specific performance targets or business goals.

Demotivator

An aspect or condition that reduces motivation or enthusiasm.

Q13: Within the relevant range, which of the

Q29: XYZ uses job costing. Actual manufacturing overhead

Q55: The end goal of process costing and

Q77: Mixed costs are purely fixed.

Q106: Beaver Company manufactures coffee tables and uses

Q136: The May Corporation uses a process system.

Q161: Manufacturing overhead has an underallocated balance of

Q242: How is the cost of direct materials

Q243: An example of an industry that uses

Q294: The difference between the sales price and