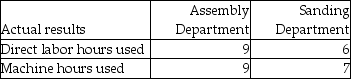

Lucas Industries uses departmental overhead rates to allocate its manufacturing overhead to jobs. The company has two departments: Assembly and Sanding. The Assembly Department uses a departmental overhead rate of $60 per machine hour, while the Sanding Department uses a departmental overhead rate of $30 per direct labor hour. Job 603 used the following direct labor hours and machine hours in the two departments:  The cost for direct labor is $35 per direct labor hour and the cost of the direct materials used by Job 542 is $1500.

The cost for direct labor is $35 per direct labor hour and the cost of the direct materials used by Job 542 is $1500.

What was the total cost of Job 542 if Lucas Industries used the departmental overhead rates to allocate manufacturing overhead?

Definitions:

Market Supply And Demand

The economic model that explains the interaction between the supply of goods and services and the demand for them, determining their market prices.

Marginal Cost

A rise in the cumulative expenses associated with the production of an extra unit.

Economic Rent

Extra income earned by a factor of production due to its limited supply or unique properties, over and above its opportunity cost.

Output Tax

A tax levied on the quantity of production or output generated by a company, as opposed to income or profit.

Q17: To find the "cost per equivalent unit,"

Q63: The use of which of the following

Q69: The Sit-N-Spin Corporation manufactures and assembles office

Q73: Stars and Stripes Corporation uses job costing.

Q114: When units are transferred from Processing Department

Q147: Process costing is used by companies that

Q204: Telecom uses activity-based costing to allocate all

Q232: The total cost of a product equals

Q253: A transfer of $30,000 from the assembly

Q310: The amount of overallocation or underallocation is