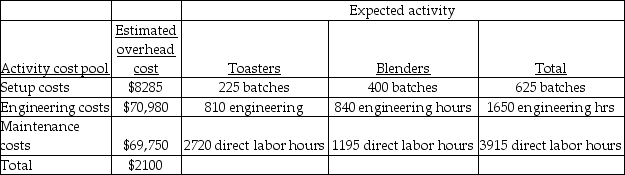

Vandalay Industries manufactures two products: toasters and blenders. The annual production and sales of toasters is 2100 units, while 1500 units of blenders are produced and sold. The company has traditionally used direct labor hours to allocate its overhead to products. Toasters require 1.25 direct labor hours per unit, while blenders require .75 direct labor hours per unit. The total estimated overhead for the period is $149,015. The company is looking at the possibility of changing to an activity-based costing system for its products. If the company used an activity-based costing system, it would have the following three activity cost pools:  The predetermined overhead allocation rate using the traditional costing system would be closest to

The predetermined overhead allocation rate using the traditional costing system would be closest to

(Round all answers to two decimal places.)

Definitions:

Firm

A business organization, such as a corporation, partnership, or sole proprietorship, engaged in professional, commercial, or industrial activities.

Labor Hours

Labor hours refer to the total number of hours worked by employees within a specified period, often used to measure productivity and labor costs.

Capital

Financial assets or the financial value of assets, such as funds held in deposit accounts, as well as the tangible machinery and production equipment used in environments such as factories.

Price Ceilings

a government-imposed limit on how high a price can be charged for a product, service, or commodity.

Q24: Back Porch Company manufactures lawn chairs using

Q57: On a production cost report, where would

Q101: Augustine Associates is a CPA firm that

Q118: During a period, 43,200 units were completed

Q133: How is the cost per equivalent unit

Q138: Which of the following condition(s)favors using departmental

Q176: Under which of the following situations is

Q214: Total mixed cost is represented by which

Q244: OPG Company manufactures display cases to be

Q275: The equation for a straight line is