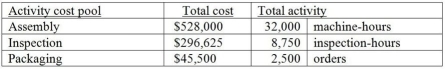

Burning River Corporation, a manufacturer of a variety of products, uses an activity-based costing system. Information from its system for the year for all products follows:

Burning River Corporation makes 750 of its product X14 a year, which requires a total of 55 machine hours, 20 inspection hours, and 18 orders. Product X14 requires $77.00 in direct materials per unit and $65.00 in direct labor per unit. Product X14 sells for $195 per unit.

Burning River Corporation makes 750 of its product X14 a year, which requires a total of 55 machine hours, 20 inspection hours, and 18 orders. Product X14 requires $77.00 in direct materials per unit and $65.00 in direct labor per unit. Product X14 sells for $195 per unit.

Required:

a. Calculate the cost pool activity rate for each of the three activities.

b. How much manufacturing overhead would be allocated to Product X14 in total?

c. What is the profit margin in total for Product X14?

Definitions:

Partnership Act

Legislation that outlines the rights and responsibilities of partners in a business partnership.

Profits

The financial gain realized when the revenue generated from business activities exceeds the expenses, taxes, and costs associated with sustaining the operations.

Carrying On Business

The ongoing conduct of commercial activities with some degree of regularity or continuity for profit.

Unlimited Liability

A legal structure in which owners and partners are personally and fully responsible for all the debts and liabilities of the business.

Q60: OP Technologies Manufacturing manufactures small parts and

Q97: When a job is completed, the journal

Q99: Showboat Corporation had actual manufacturing overhead costs

Q117: The following information was gathered for the

Q157: The journal entries needed for job costing

Q235: The cost of downtime caused by quality

Q282: Which of the following is not a

Q284: In the basic flow of inventory through

Q285: How do you calculate the predetermined manufacturing

Q326: The journal entry needed to record the