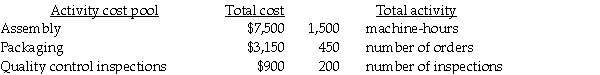

Duquesne Incorporated recently implemented an activity-based costing system. Total results from all products manufactured in the current year are:

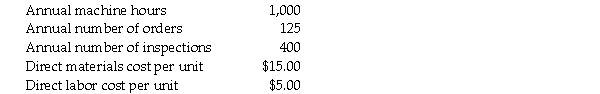

Duquesne manufactures sprinkler heads for commercial applications. Annual production and sales of one of its heads, is 2,300. The following relates to the most recent year.

Duquesne manufactures sprinkler heads for commercial applications. Annual production and sales of one of its heads, is 2,300. The following relates to the most recent year.

Required:

Required:

1. Calculate the activity cost pool rates for each of the three activity cost pools listed.

2. Calculate the average cost of one sprinkler head.

Definitions:

Milgram's Study

A series of psychological experiments conducted by Stanley Milgram, which aimed to measure the willingness of participants to obey an authority figure who instructed them to perform acts conflicting with their personal conscience.

Cross-Cultural Research

Studies that compare aspects of two or more cultures to understand their differences and similarities.

Human Universal

A term referring to elements and behaviors that are found and recognized across all cultures and societies.

Base Of Power

The underlying sources of influence or authority one has over others, such as expertise, coercion, or referred authority.

Q37: If jobs have been undercosted due to

Q43: The manager at Rainbow International prepares a

Q55: Process costing is most likely used in

Q91: Stanley Company uses a job cost system.

Q92: Total direct materials = $67,500, and there

Q147: Process costing is used by companies that

Q164: Briefly explain the difference between job order

Q191: Rent on a factory building would likely

Q205: Here is some basic data for Delta

Q285: How do you calculate the predetermined manufacturing